In the Crypto / Defi space, much innovation is going on. While Ethereum is the dominant blockchain for the Defi economy, many other chains are currently building and developing competitive Defi systems, including Algorand, Avalanche, Cosmos, Polkadot, Tezos, Solana, and others.

While these are constructing a parallel Defi ecosystem to Ethereum, the number of new blockchains being launched is increasing. They are layer two protocols, side-chains, sharding or parachains, or EVM compatible blockchains, and their primary purpose is to provide scaling solutions. Arbitrum, BSC, and Matic are a few examples.

With an expanding set of Layer 1 networks and Layer 2 side-chain protocols, the future of Defi will be a cross-chain, bridging different networks and bringing Defi to the masses.

So what are cross-chain bridges, and what kind of help can cross-chain swaps bring to your projects?

1. What are the cross-chain swaps?

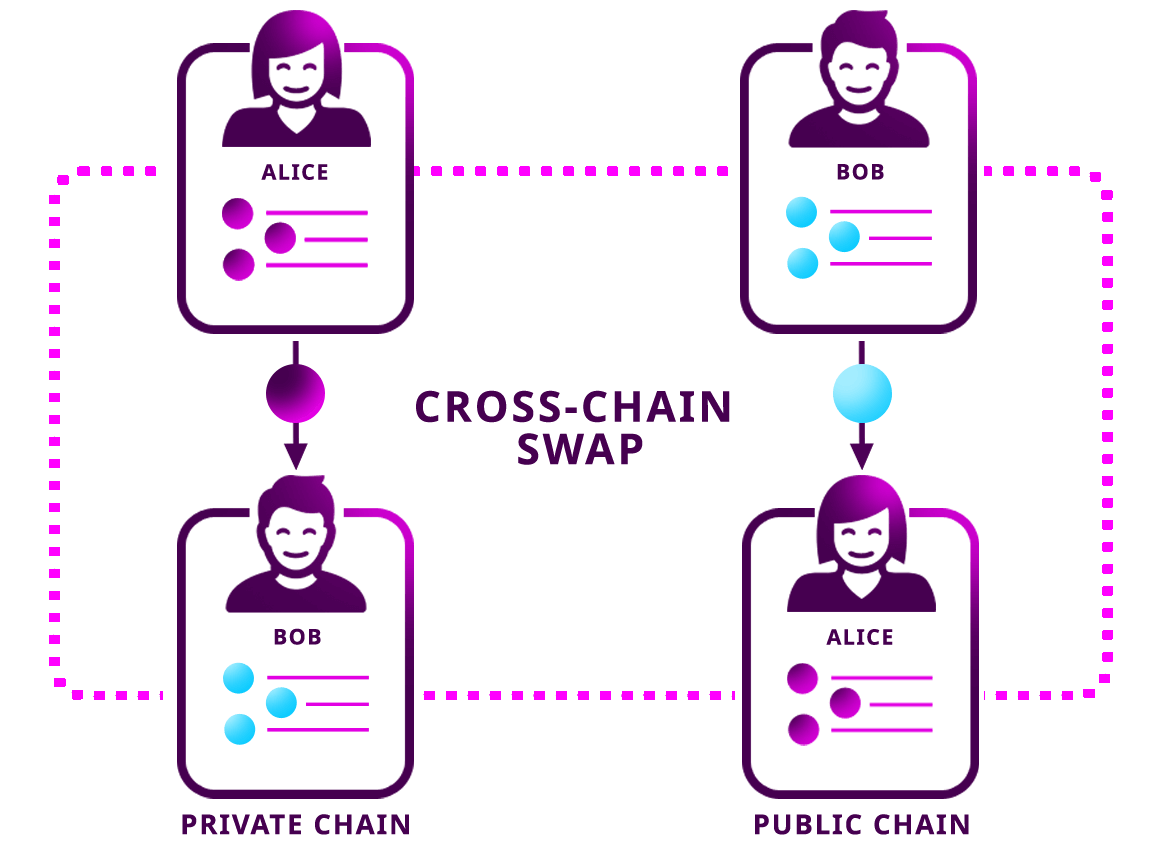

Cross-chain swaps, also known as atomic swaps, move coins and tokens from one blockchain to another that run on a completely unique system. Cross-chain swaps are accomplished by Defi participants using cross-chain bridges.

2. Two types of cross-chain swaps can bring to your projects

Cross-chain swaps are classified into two types: centralized cross-chain bridges and decentralized trustless cross-chain bridges.

Centralized cross-chain bridges

The centralized cross-chain bridge employs a centralized system based on third-party trust. People used the bridge solution offered by exchanges in the early days to swap their assets between blockchains.

Even today, you can swap and transfer your Ethereum ERC20 to Solana chain, BEP20 (Binance Smart Chain), Polygon network, ARC20 Avalanche chain, and many other supported chains from your Binance account. Not only Binance, but many exchanges allow you to swap tokens between blockchains.

These bridges, also known as wrapped bridges, issue pegged tokens that are matched on either blockchain. One of the most popular trust-based bridge scenarios is the initiative that allows Bitcoin hodlers to transfer their BTC as Wrapped Bitcoin (WBTC) to the Ethereum blockchain. Once transferred, they can take advantage of the Defi benefits on Ethereum.

Users deposit BTC into a partner wallet via the centralized bridge. It is essentially a centralized trusted custodian wallet that securely stores your Bitcoin and mints equivalent wrapped BTC (WBTC) or tBTC tokens on the Ethereum network.

It essentially locks up Bitcoin and mints equivalent Bitcoin tokens on Ethereum. When you want to transfer BTC back to the Bitcoin network, the wrapped tokens on Ethereum will be locked or burned, and your locked BTC on Bitcoin will be unlocked.

Wrapped BTC on the Ethereum network is an ERC20 token that can be used as collateral in several Decentralized Finance (Defi) protocols, including Uniswap, Aave, Maker DAO, Compound, Synthetix, Curve, Sushiswap, Balancer, 0x Protocol, and many others.

These centralized services that facilitate cross-chain activity have some drawbacks, such as high transfer fees, the requirement of KYC registration, and so on. However, users no longer rely on centralized services to perform token swaps.

There are many decentralized cross-chain bridges–a new protocol that allows users to transfer assets between blockchains without relying on a centralized third-party service. Users can now move their assets between blockchains automatically and without requiring permission.

Decentralized trustless cross-chain bridges

While centralized bridges rely on third-party trust, decentralized or trustless cross-chain bridges rely on cryptographic mathematical trust.

Unlike CEX, users in a decentralized system are not required to sign up, and no user data is collected. Users can place their trust in the mathematical truth rather than a centralized authority. The mathematical truth is achieved in a blockchain system when computer nodes or a program reach a common agreement (consensus) by the rule specified in the underlying blockchain’s codebase.

Decentralized cross-chain bridges enable cross-chain swaps in an utterly decentralized mechanism, eliminating the need for a middleman or escrow. They accomplish this through the use of smart contracts.

A cross-chain swap is a completely decentralized mechanism for exchanging tokens from one chain for tokens from another. It is carried out using special smart contracts – an application or program that connects two different networks and automatically exchanges tokens when certain conditions are met.

Conclusion

Cross-chain swap represents a futuristic model for token exchange and payment decentralization. It’s a simple way for two participants to exchange tokens on completely different protocols without intermediaries. The cross-chain swap results from blockchain’s core focus on increasing interoperability over time, enticing people to decentralization as they struggle with a centralized system. As a result, organizations now prefer a decentralized system, with blockchain-based solutions built on various protocols. As a result, cross-chain swaps will be extremely popular in this advanced world.

If you are interested in developing a cross-swap-powered decentralized exchange or a full range of blockchain solutions for your business, contact SmartOSC blockchain experts and discuss your project requirements.

Contact us if you have any queries about Blockchain development services, dApps development, NFT marketplace development, Crypto wallet development, Smart contracts development.