Short for peer-to-peer, P2P networks are a type of distributed network application that dates back to the 1980s when they were first deployed for business purposes. However, the concept was introduced to the public in 1999 when college student Shawn Fanning created a music sharing service, Napster. Nowadays, Peer to peer transfer plays an important role in our technology management. Let’s talk about the reason of peer-to-peer transfers are essential for blockchain.

What is peer-to-peer

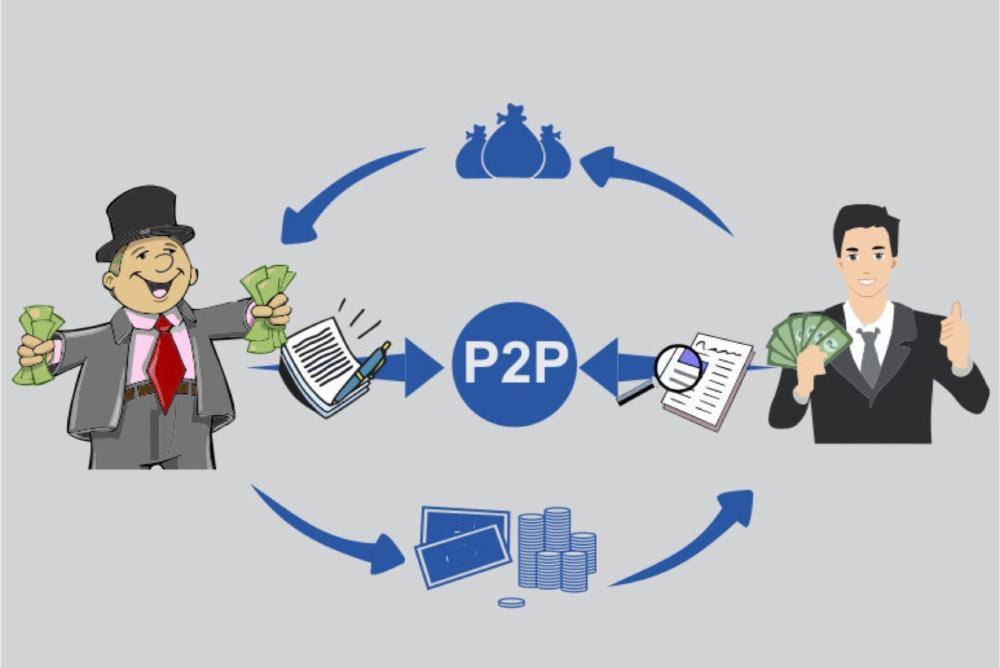

Peer-to-peer money transfers use a website or app to transfer money from one person to another over the internet or mobile network. For international payments, peer-to-peer matches buyers and sellers in different currencies to deliver competitive exchange rates.

Peer to peer mechanism

Peer-to-peer is well known as a model that is maintained by a distributed network of computers. This means the computers don’t have a central server or administrator because each node keeps a copy of the files – acting as both a server and a client. Thus, each node can upload files to other nodes or download files from them.

Since each node has common capabilities for storing, transferring, and receiving files, P2P networks tend to be faster and more efficient. Unlike traditional architectures where a single point of failure exists, a P2P network has a distributed architecture that makes it extremely resistant to cyberattacks.

Why peer-to-peer transfers are essential for blockchain

Estimated rates

When you sign up for a peer-to-peer transfer, the low margins can be attractive and the rates are certainly competitive. The only problem is about the rate. In these circumstances, it’s normal if he rate you see may not be the rate you get. P2P sites will publish rates available now, but by the time your deal is placed and paid for (it can take 3-5 days to find a buyer), the currency rate may already have significant changes. With P2P, you never know how much you’ll actually get until the deal is done. At OFX, when you place a trade with us, the price is fixed. What you see is what you will get.

Delayed processing

Currencies change quickly and suddenly, and P2P models automatically pause your transfers if the currency has increased by 3% from when you placed the trade. When that happens, you may have to wait an extra week to receive your money. If you can’t afford to wait, that type of delay could be the problem.

Imbalanced buyers and sellers

P2P transfers rely on having the same number of buyers and sellers available at any given time. When this balance does not exist, as happened during Brexit, you may not be able to make a transaction and you may miss out on a large exchange rate. Look for a company with a strong online platform and established banking relationships so you can take control of your money.

Hope that through this article and deep analysis, you have your own knowledge about Peer to peer and peer to peer transfer.

If you want to know more about peer to peer transfer, contact smartOSC right here.

Contact us if you have any queries about Blockchain development services, dApps development, NFT marketplace development, Crypto wallet development, Smart contracts development.