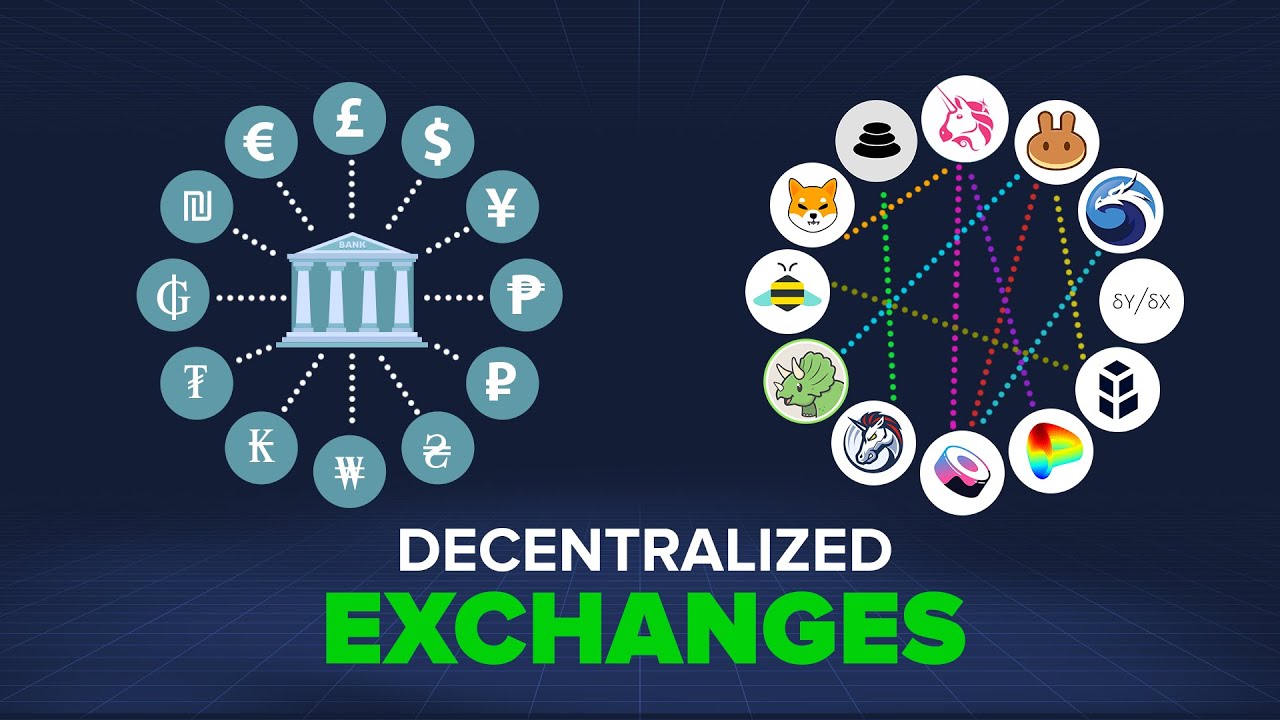

Peer-to-peer exchanges known as decentralized exchanges, or DEXs, allow cryptocurrency traders to deal without surrendering their funds to an intermediary or custodian. Smart contracts, self-executing contracts created in computer code, make these transactions possible. You will learn everything there is to know about decentralized exchanges from this guide.

1. What is a Decentralized Exchange?

Decentralized exchanges use smart contracts to allow traders to execute orders with no intermediary. Centralized exchanges, like banks that provide other financial services and aim to make money, manage centralized exchanges.

The vast bulk of trading volume in the cryptocurrency market is conducted on centralized exchanges since they are licensed organizations that custody of customers’ cash and offer beginner-friendly platforms. Specific centralized markets provide deposit insurance.

2. How do Decentralized Exchanges work?

Decentralized exchanges charge a trading cost and a transaction fee since they are constructed on smart contract-compatible blockchain networks and let users keep custody of their money. To use DEXs, traders communicate with smart contracts on the blockchain.

Decentralized exchanges are classified into three types: order books, DEXs, automated market makers, and DEX aggregators. Their smart contracts enable users to trade directly with one another through their smart contracts. The initial decentralized exchanges used to order books that were like those used by centralized exchanges.

3. What are the advantages and disadvantages of Decentralized Exchanges?

Advantages of DEXs

- Token availability

Tokens must be carefully examined to ensure they abide by local laws before being listed on centralized exchanges. Since decentralized exchanges are built on blockchain technology, they can list any token created there. New projects will probably list on decentralized exchanges before their centralized counterparts.

- Anonymity

Users’ privacy is protected on DEXs when trading one cryptocurrency for another. In contrast to centralized exchanges, users do not have to go through the Know Your Customer standard identification procedure (KYC). KYC procedures require traders to provide personal information such as their full legal name and a photograph of a government-issued identification document. As a result, DEXs attract many people who do not want to be identified.

- Reduced security risks

Experienced bitcoin users who have custody of their coins are less likely to be hacked because DEXs do not control their funds. Instead, investors safeguard their money and only use the exchange when they wish to. Only the liquidity providers might be in danger if the platform is compromised.

- Reduced counterparty risk

Counterparty risk occurs when the other party in a transaction cannot fulfill its part of the bargain and breaches its contractual obligations. Decentralized exchanges function without intermediaries and are built on smart contracts, eliminating this risk.

Users can immediately do a web search to find out whether the exchange’s smart contracts have been examined and decide based on the experience of other traders to guarantee that there are no additional dangers while utilizing a DEX.

Disadvantages of DEXs

- Specific knowledge is required

Through bitcoin wallets with smart contract communication capabilities, DEXs can be accessed. Traders must understand how to use these wallets and the security concepts associated with keeping their funds secure.

These wallets must be loaded with the tokens for each network. Other funds may become stuck without a network’s native token because the trader cannot pay the fee required to move them. Specific knowledge is needed to choose and found a wallet with the correct tokens.

- Smart contract vulnerabilities

Reputable companies analyze the smart contracts of massive decentralized exchanges, enhancing code security. Error is human. Exploitable defects can, therefore, continue to evade audits and other types of code assessments. It’s possible that auditors won’t be able to foresee upcoming vulnerabilities that could cost liquidity providing their tokens.

- Unvetted token listings

Anyone with access to a decentralized exchange can list a new token and provide liquidity by pairing it with other coins. This makes investors vulnerable to scams such as rug pulls, which trick them into thinking they are purchasing a different token.

Conclusion

Although centralized exchanges continue to dominate crypto markets and serve the needs of everyday crypto traders and investors, decentralized exchanges offer an intriguing alternative. DEXs provide a trustless method of connecting buyers and sellers via on-chain smart contracts and new models of fair involvement and governance for stakeholders. If you need help with blockchain services, contact SmartOSC.

Contact us if you have any queries about Blockchain development services, dApps development, NFT marketplace development, Crypto wallet development, Smart contracts development.