Money and payments have developed continuously throughout history. This is also true in the digital age. We rely less on cash as we increasingly pay digitally and shop online. Wallets are gradually transitioning from pockets to smartphones and other electronic devices.

These developments have far-reaching implications for money, asking whether central banks should issue digital currencies for retail use.

Today SmartOSC will argue that in a digital world, CBDCs are required to maintain central bank money’s role as a stabilizing force at the heart of the payments system and safeguard monetary sovereignty.

1. What is CBDC?

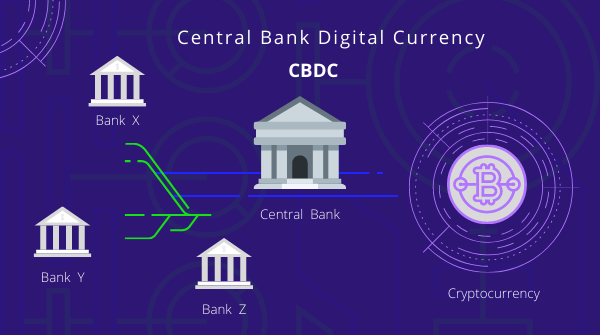

CBDC stands for Central Bank Digital Currency, which are digital tokens similar to cryptocurrency. They are determined by the value of the country’s fiat currency. CBDCs are being developed and implemented in many countries. Because so many countries are looking into digital currencies.

CBDCs’ primary goal is to provide privacy, convenience, transferability, accessibility, and financial security to businesses and consumers. Central bank digital currencies would also reduce the risks associated with the current form of digital currencies.

2. Need for CBDC

CBDC will be supported by distributed ledger technology (DLT), but it will be a permissioned blockchain, distinguishing it from other permission fewer crypto assets. The central monetary authority will have control over blockchain access. As paper currency usage declines, central banks are attempting to popularize a more acceptable electronic form of currency. Digital currency will be more efficient and avoid private currencies’ negative consequences.

3. The significant benefits of CBDC

CBDC will serve as the last payment, eliminating the risk of settlement in the financial system, particularly among banks. The CBDC will be the actual store of value, transferring value from one entity to another. It will cause lower transaction costs and a more effortless flow of money. CBDCs will transition to real-time transactions and a globalized, cost-effective payment settlement system. For example, Indian importers can pay an American exporter in digital dollars in real-time with no intermediary.

It would not even be necessary for the US Federal Reserve system to be open for settlement. Time zone differences would no longer affect currency settlements. Because CBDCs are as good as fiat currencies, this transaction would be final.

Compared to existing forms of money, the CBDC has the potential to offer benefits in terms of liquidity, scalability, acceptance, ease of transactions, and faster settlement, according to a note released by the State Bank of India (SBI). Soon, there may be a pragmatic shift to a cashless economy. CBDC adoption will improve and make it easier for people to use with the government’s supporting infrastructure. It will help the government’s mission to transition to a digital economy. It can create an environment for interoperability, allowing for faster real-time remittance.

Conclusion

CBDCs are designed similarly to cryptocurrencies but may not require blockchain technology or consensus mechanisms. CBDCs are designed to be stable and safe by mirroring the value of fiat currency. CBDCs, backed by the government and controlled by the central bank, would provide a stable means of exchanging digital currency for households, consumers, and businesses. If you need or want advice on blockchain development services, don’t hesitate to contact SmartOSC.

Contact us if you have any queries about Blockchain development services, dApps development, NFT marketplace development, Crypto wallet development, Smart contracts development.