Peer-to-peer exchanges known as decentralized exchanges, or DEXs, allow cryptocurrency traders to deal without surrendering their funds to an intermediary or custodian. Smart contracts, self-executing contracts created in computer code, make these transactions possible. You will learn everything there is to know about decentralized exchanges from this guide.

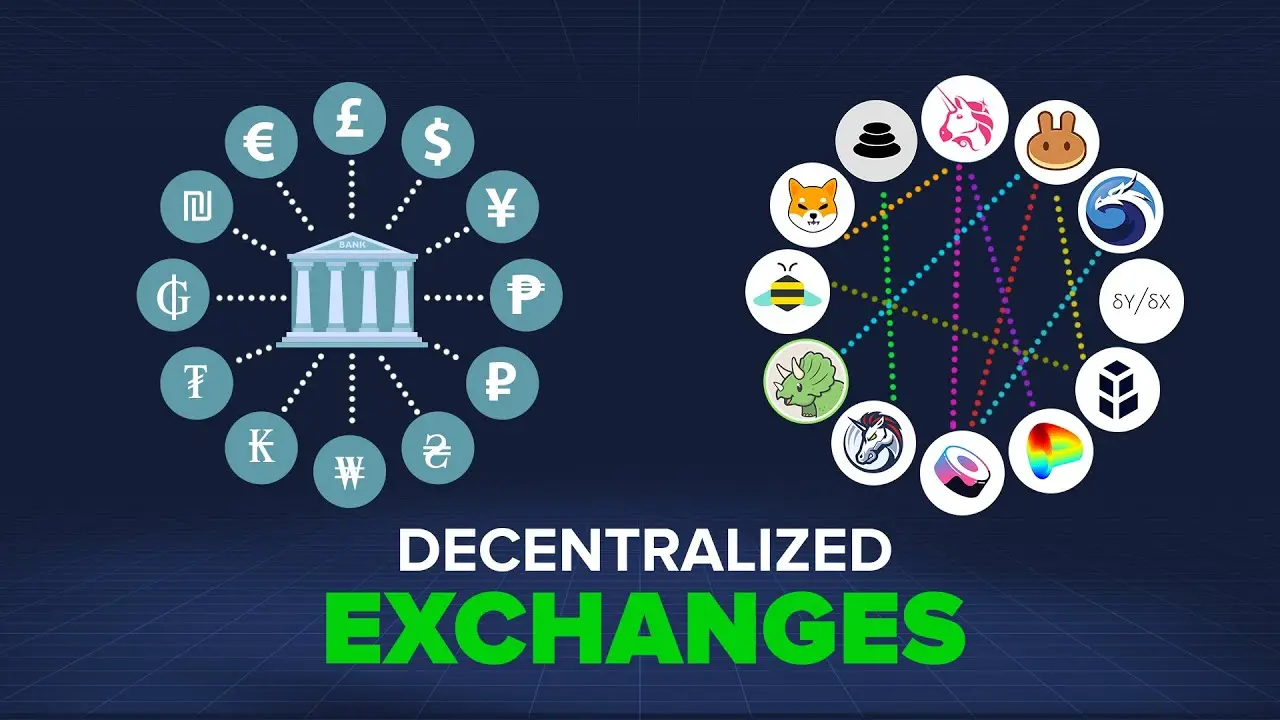

Decentralized exchanges use smart contracts to allow traders to execute orders with no intermediary. Centralized exchanges, like banks that provide other financial services and aim to make money, manage centralized exchanges.

The vast bulk of trading volume in the cryptocurrency market is conducted on centralized exchanges since they are licensed organizations that custody of customers’ cash and offer beginner-friendly platforms. Specific centralized markets provide deposit insurance.

Decentralized exchanges charge a trading cost and a transaction fee since they are constructed on smart contract-compatible blockchain networks and let users keep custody of their money. To use DEXs, traders communicate with smart contracts on the blockchain.

Decentralized exchanges are classified into three types: order books, DEXs, automated market makers, and DEX aggregators. Their smart contracts enable users to trade directly with one another through their smart contracts. The initial decentralized exchanges used to order books that were like those used by centralized exchanges.

Tokens must be carefully examined to ensure they abide by local laws before being listed on centralized exchanges. Since decentralized exchanges are built on blockchain technology, they can list any token created there. New projects will probably list on decentralized exchanges before their centralized counterparts.

Users’ privacy is protected on DEXs when trading one cryptocurrency for another. In contrast to centralized exchanges, users do not have to go through the Know Your Customer standard identification procedure (KYC). KYC procedures require traders to provide personal information such as their full legal name and a photograph of a government-issued identification document. As a result, DEXs attract many people who do not want to be identified.

Experienced bitcoin users who have custody of their coins are less likely to be hacked because DEXs do not control their funds. Instead, investors safeguard their money and only use the exchange when they wish to. Only the liquidity providers might be in danger if the platform is compromised.

Counterparty risk occurs when the other party in a transaction cannot fulfill its part of the bargain and breaches its contractual obligations. Decentralized exchanges function without intermediaries and are built on smart contracts, eliminating this risk.

Users can immediately do a web search to find out whether the exchange’s smart contracts have been examined and decide based on the experience of other traders to guarantee that there are no additional dangers while utilizing a DEX.

Through bitcoin wallets with smart contract communication capabilities, DEXs can be accessed. Traders must understand how to use these wallets and the security concepts associated with keeping their funds secure.

These wallets must be loaded with the tokens for each network. Other funds may become stuck without a network’s native token because the trader cannot pay the fee required to move them. Specific knowledge is needed to choose and found a wallet with the correct tokens.

Reputable companies analyze the smart contracts of massive decentralized exchanges, enhancing code security. Error is human. Exploitable defects can, therefore, continue to evade audits and other types of code assessments. It’s possible that auditors won’t be able to foresee upcoming vulnerabilities that could cost liquidity providing their tokens.

Anyone with access to a decentralized exchange can list a new token and provide liquidity by pairing it with other coins. This makes investors vulnerable to scams such as rug pulls, which trick them into thinking they are purchasing a different token.

Although centralized exchanges continue to dominate crypto markets and serve the needs of everyday crypto traders and investors, decentralized exchanges offer an intriguing alternative. DEXs provide a trustless method of connecting buyers and sellers via on-chain smart contracts and new models of fair involvement and governance for stakeholders. If you need help with blockchain services, contact SmartOSC.

Increased acceptance and knowledge sharing have aided the spontaneous growth of cryptocurrency over the last…

Blockchain can be intimidating to research, but attending cryptocurrency events is one of the best…

Blockchain has made inroads into all major industries and is also becoming a part of…

In recent years, blockchain lending solutions have grown in popularity as a way to earn…

The scalability trilemma is still one of the blockchain's most pressing issues. Here are some…

Many people are looking for ways to get involved in the crypto world as the…